SUPREME COURT HOLDS THAT THE HIGHEST STAMP DUTY PAYABLE IN CASE OF ALTERATION OF ARTICLES OF THE COMPANY, IS A ONE-TIME MEASURE

In a recent matter of State of Maharashtra vs National Organic Chemical Industries Ltd. Civil Appeal No. 8821 of 2011, a two Judge Bench of the Supreme Court comprising of Justice Sudhanshu Dhulia and Justice Prasanna B. Varale passed a Judgment dated 05-04-2024 and made observations regarding stamp duty chargeable in case of increase in the share capital of a company.

Facts

i) In the present case, the Respondent- National Organic Chemical Industries Ltd. was incorporated with an initial share capital of Rs. 36 Crores. Thereafter, the share capital was increased to Rs. 600 Crores in 1992, for which a stamp duty of Rs. 1,12,80,000/- (Rupees One Crore Twelve Lakhs Eighty Thousand only) was paid, as per Article 10 of Schedule-I of the Bombay Stamp Act, 1958 (i.e. in respect of increase in share capital as recorded in the Articles of Association of Company).

ii) Thereafter, the State of Maharashtra amended Article 10 of Schedule-I of the Bombay Stamp Act on 02-08-1994 and introduced a maximum cap of Rs. 25 Lakhs on stamp duty payable by a company w.e.f. 01-08-1994.

iii) Subsequently, the Company passed a resolution to further increase its share capital to Rs. 1200 Crores and paid a stamp duty thereof i.e. Rs. 25 Lakhs and informed the Registrar of Companies (ROC) about the same, pursuant to Section 97 of the Companies Act, 1956 (Notice of increase of share capital or of members).

iv) Soon thereafter, the Company realised that it should not have paid the stamp duty at the second instance, as the Company had already paid more than the maximum stamp duty payable, in 1994.

v) Hence, the Respondent wrote a Letter to the Appellant No. 2- the Deputy Superintendent of Stamps, Maharashtra, seeking a refund of the payment of Stamp Duty of Rs. 25 Lakhs that the Appellant inadvertently paid at the second instance of increase of share capital.

vi) The Appellant No. 2 turned down the request of the Respondent, vide Order dated 20-01-1998 on the ground that stamp duty is payable on each occasion of increase in authorised share capital of a company at the time of filing Form No. 5 with ROC and that it is not a one-time measure.

vii) Aggrieved, the Respondent filed a Writ Petition bearing WP / 1844 / 1998 before the Hon’ble Bombay High Court.

viii) The High Court, vide Order dated 18-08-2009, allowed the Respondent’s Writ Petition on the ground that that Form No. 5 is not an instrument as defined by Section 2 (l) of the Bombay Stamp Act[1] and that the maximum stamp duty i.e. Rs. 25 Lakhs can only be charged on Articles of Association, which in this case, has already been paid by the Respondent. Thus, the High Court directed the Appellants to refund Stamp Duty of Rs. 25 Lakhs along with interest @ 6% per annum.

Supreme Court Observations

Aggrieved by the High Court Order dated 18-08-2009, the Appellants filed SLP (Civil) No. 9878 of 2010 before the Hon’ble Supreme Court, which was registered as Civil Appeal No. 8821 of 2011. The Apex Court, vide Order dated 05-04-2024, made the following observations:

1) That as per the Companies Act, when a company is incorporated, it has to file certain documents with the ROC including the Memorandum of Association (MOA) and Articles of Association (AOA) pursuant to Section 33 of the Companies Act 1956 (Registration of Memorandum and Articles). If the ROC is satisfied about the compliance of the mandatory requirements, the ROC will register the documents filed by the company.

2) During the course of business operations, a company is empowered to (i) alter its AOA by passing a special resolution, as per Section 31 of the Companies Act (Alteration of Articles by Special Resolution); (ii) alter its share capital, as authorised by the AOA, by passing a resolution in a general meeting, as per Section 94 of the Companies Act (Power of limited company to alter its share capital).

3) Thereafter, the ROC has to be notified about such resolution of the company to alter its share capital, pursuant to Section 97 of the Companies Act (Notice of increase of share capital or of members). The same implies that it is the ROC who is the custodian of the AOA of a company and not the company itself.

4) Thus, when a company has to alter the AOA or modify its share capital as recorded in AOA, it has to (a) pass a resolution, (b) file Form No. 5 with ROC and (c) pay stamp duty on Form No. 5, as stipulated in Article 10 of Schedule-I of the Bombay Stamp Act. The Registrar then has to record such increase in share capital or members, and carry out necessary alterations in AOA.

5) That Section 3 of the Bombay Stamp Act provides that stamp duty is payable on instruments which are executed in the State of Maharashtra and that the duty payable is the amount indicated in Schedule-I of the Stamp Act. Further, an ‘instrument’ is defined under Section 2(l) of the Bombay Stamp Act to include every document by which any right or liability is created or transferred, etc.

6) That, in respect of the main issue that whether the maximum cap of Rs.25 Lakhs on stamp duty payable in case of alteration of AOA due to increase in share capital, would be applicable as a one-time measure or at the time of each subsequent increase in the share capital of the company, the Bench observed as follows:

i) That Stamp Duty is affixed on Form No. 5 as a matter of practical convenience because a company itself cannot carry out the alterations and record the increase in share capital in its Articles of Association. It is only the articles which are an instrument within the meaning of Section 2(l) of the Stamp Act and accordingly have been mentioned in Article 10 of Schedule-I of the Stamp Act.

ii) That Section 31 (2) of the Companies Act states that “Any alteration so made shall, subject to the provisions of this Act, be as valid as if originally contained in the articles and be subject in like manner to alteration by special resolution.” This implies that any increase in the share capital of the company shall be valid as if it were originally there when the AOA was first stamped.

iii) Further, Article 10 of Schedule I of Bombay Stamp Act clearly provides that stamp duty will be charged on subsequent increase in the authorised share capital of the company, subject to a maximum cap of Rs. 25 Lakhs.

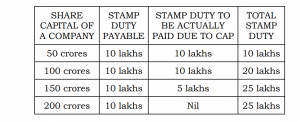

“In other words, the ceiling of Rs. 25 lakhs in Column 2 is applicable on Articles of Association and the increased share capital therein, not on every increase individually. In case stamp duty equivalent to or more than the cap has already been paid, no further stamp duty can be levied. For a better understanding, let us consider a hypothetical example:”

“The fact that the maximum cap of Rs.25 lakhs would be applicable as a one-time measure and not on each subsequent increase in the share capital of a company is fortified directly by the Maharashtra Stamp (Amendment) Act, 2015 which amended the charging section for Articles of Association i.e., Article 10 of the Stamp Act”

iv) Further, with respect to the applicability of 2015 amendment to stamp duty paid prior to such amendment, the Bench observed that although the 2015 amendment would not have retrospective effect, but as the instrument i.e. AOA remains the same and the increase was initiated by the Respondent after the cap was introduced, hence, the duty already paid on the same instrument i.e. AOA will have to be considered. “It is not a fresh instrument which has been brought to be stamped, but only the increase in share capital in the original document, which has been specifically made chargeable by the Legislation.”

Conclusion

Thus, based on the aforesaid observations, the Apex Court held that the Schedule I of the Bombay Stamp Act provides for levy of stamp duty at the time of alteration of AOA due to increase in share capital and that the maximum cap of Rs. 25 Lakhs on stamp duty payable in case of alteration of AOA due to increase in share capital, would be applicable as a one-time measure and not on each subsequent increase in the share capital of the company. As a result, the Appeal filed by the Appellants was dismissed and upheld the High Court Order dated 18-08-2009 that directed the Appellants to refund Stamp Duty of Rs. 25 Lakhs along with interest @ 6% per annum.

Harini Daliparthy

Senior Associate

The Indian Lawyer

[1] Section 2 (l) of the Bombay Stamp Act 1958:

“(l) instrument” includes every document by which any right or liability is, or purports to be, created, transferred, limited, extended, extinguished or recorded, but does not include a bill of exchange, cheque, promissory note, bill of lading, letter of credit, policy of insurance, transfer of share, debenture, proxy and receipt.”

Leave a Reply